From soda cans to foundations for buildings, aluminum and steel are key components in many products in America. These products play an important part in American life, but President Donald Trump recently imposed a 25 percent tax on steel imports and a 10 percent tax on aluminum. The fines were placed specifically to target Chinese imports with the Trump administration claiming China’s previous imports threatened national security, putting three billion dollars worth of taxes on China’s imports of steel and aluminum.

Tariffs are a form of tax imposed on imports or exports that are emplaced by a country’s government that increase the price of something imported or exported. They are often identified with protectionism, the economic policy of maintaining higher prices for international goods in order to drive business to national manufacturers. However, since tariffs increase the price of imported goods, consumers must spend more money to buy foreign products. In this case, the tariffs have been levied to reduce industrial dependency on cheaper foreign steel.

These tariffs target all countries except for Canada, Mexico, the European Union, Australia, Argentina, Brazil and South Korea, having been temporarily exempted from receiving a tariff on steel and aluminum imports until June 1. Trump stated that the order would show “great flexibility and cooperation toward those that are real friends.” This means that close allies with the United States will most likely be exempted from tariffs.

Even with these exceptions to the tax, they are temporary and could lead to future problems with allied countries. If Trump were to tax Canadian imports, then some difficulties could arise due to the fact that Canada is the leading exporter of steel and aluminum to the U.S., having exported 7.2 billion dollars of aluminum and 4.3 billion dollars of steel in 2017. If tariffs were placed on Canada, the prices of many common tools and appliances would rise. The price of cars would also rise, which have a primarily steel foundation currently, but recently there has been a surge of cars using aluminum primarily since it is a lighter metal.

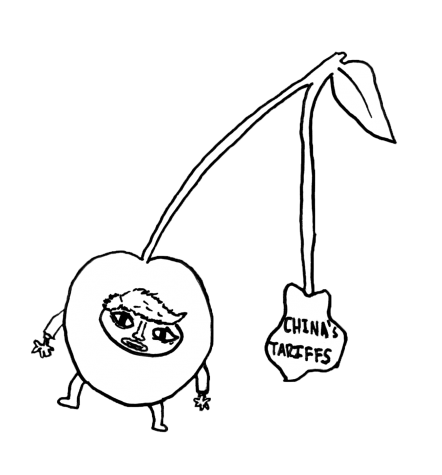

In response, China placed tariffs of their own on 128 products from the U.S., including a 15 percent excise on apples, cherries and wine from Washington. This worries many farmers as China is the top export market for Washingtonian cherries and apples, buying 140 million dollars worth of cherries, 50 million dollars worth of apples and 1.2 million dollars worth of wine in 2017. The imposition of the new tariffs has caused unease in the Washington State Fruit Commission.

“Everybody is getting pretty nervous about it; I’m also very nervous about it” said Keith Hu, the international program director of the Washington State Fruit Commission, “This is my twelfth season, promoting cherries into China. We’ll see where it goes with this tariff.”

The results of these tariffs have led to strong opinions from various political groups and industrial lobbies. Metal production companies in the U.S. are pro-tariffs due to the potential increase in the worth of their metal and potential increase in sales.

Many interest groups oppose the tariffs as well. Major companies that produce items requiring large amounts of metal, such as cars, are opposed to the tariffs since the price of metal might increase.Additionally, many farmers in the U.S. have their crop at risk of not being sold to other countries who might put tariffs on U.S. products. Many are against these tolls mostly due to the increase in prices or decrease in sales internationally. Car companies would need to use more expensive American metal to create their products.

Trump does not intend on stopping at steel and aluminum, as he has already threatened to put around 100 billion dollars of additional tariffs on Chinese products. This has lead to China responding with their own threat of putting taxes on roughly 100 billion dollars in return. Trump has stated that he is willing to start a trade war between the U.S. and China.